How much space is there for iron ore to fall?

Raw material situation:

Recently, Credit Suisse predicts that the average price of iron ore powder in 2021 will be raised from 149 US dollars/ ton to 179 US dollars/ton; the forecasted average price of 2022 will be raised from 120 US dollars/ton to 144 US dollars/ton. For China, the world's largest iron ore importer, it also suffers from high-priced iron ore.

Since the end of last year, iron ore prices have been going up all the way. In mid-May, the Platts Iron Ore Index hit a new all-time high of 223.8, and then maintained fluctuations in the 210 first-line range. Then the domestic large-scale actual reduction of steel production in the second half of the year. The measures will enter the implementation stage. Whether the price of iron ore can form an obvious pressure on the situation, the author will analyze from the following two aspects.

First, from the perspective of the demand side of iron ore, in the case of a global outbreak control step by step, the international market demand for iron ore is gradually enhanced, while the domestic steel production enterprises under the background of the carbon neutral target, domestic regulators will use environmental standards strictly enforced and regional measures to limit production, to achieve the goal of this year's steel output fell,However, due to the ebb and flow in the iron ore market, the demand for iron ore in other countries will increase while the demand for iron ore in China will decline, thus the overall iron ore market will be slightly tight between supply and demand, thus forming a certain support for the price of iron ore.

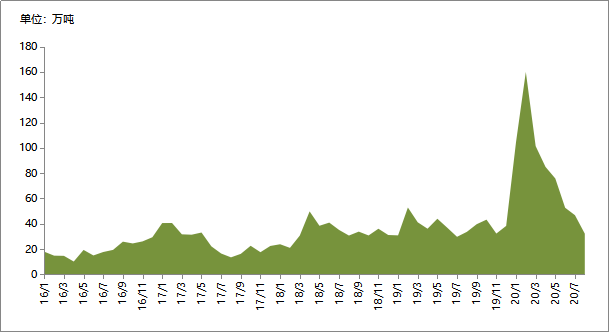

Secondly, from the perspective of iron ore supply, the global iron ore market is an oligopoly market. Due to the distribution of global minerals, a large number of high-quality and low-cost iron ore resources are mainly concentrated in the hands of the four major mines (Vale , BHP Billiton, Rio Tinto, FMG), judging from the shipments of the four major mines in the first half of the year, Brazil’s iron ore exports in June reached 33.68 million tons, the highest level in nine months. It can be seen that Vale Major iron ore producers, such as other major iron ore producers, have increased their production due to rising international prices, while the shipments of the other three major mines have basically stabilized. For the global iron ore market, short-term tight supply will benefit iron ore prices. Maintain a high position.

For the global iron ore market, there are still many uncertain factors in the second half of the year, such as the recurrence of the epidemic, the degree of recovery of the global economy, the actual effect of China's reduction in steel production, and the market operation practices of mining companies. Obviously affect the trend of iron ore prices